reit tax benefits uk

A potentially high tax bill. If it pays a dividend to.

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

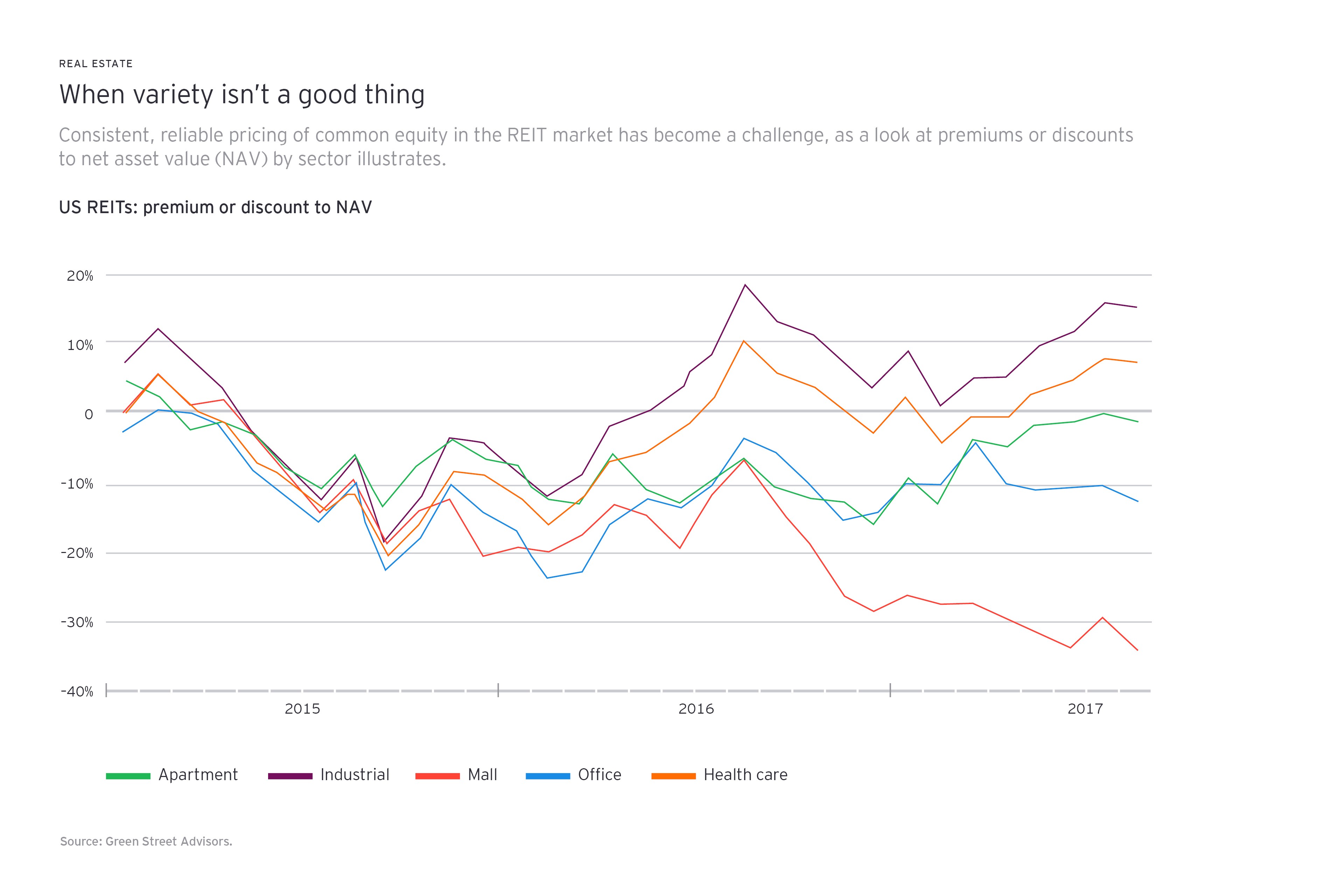

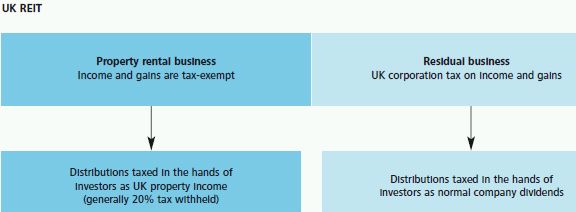

A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business.

. While REITs are tax-efficient for investors using ISAs or SIPPs investments in REITs outside of these accounts could incur large tax bills. A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business carried on in the UK. 5 rows Advantage 3 - Tax Efficiencies.

A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. The following Corporation Tax guidance note Produced by Tolley provides comprehensive and up to date tax information.

Reit tax benefits uk Saturday February 26 2022 Edit. The income from a REIT investing in. Get your free copy of The Definitive Guide to Retirement Income.

Your REIT Income Only Gets Taxed Once When a typical corporation makes money it has to pay taxes on its profits. Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors. In the hands of the shareholder property income distributions PID are taxable as profits of a UK.

These three REITs have an average dividend yield of 67. This allows it to benefit from exemptions from UK. Furthermore a REIT is able to benefit from a rebasing of underlying.

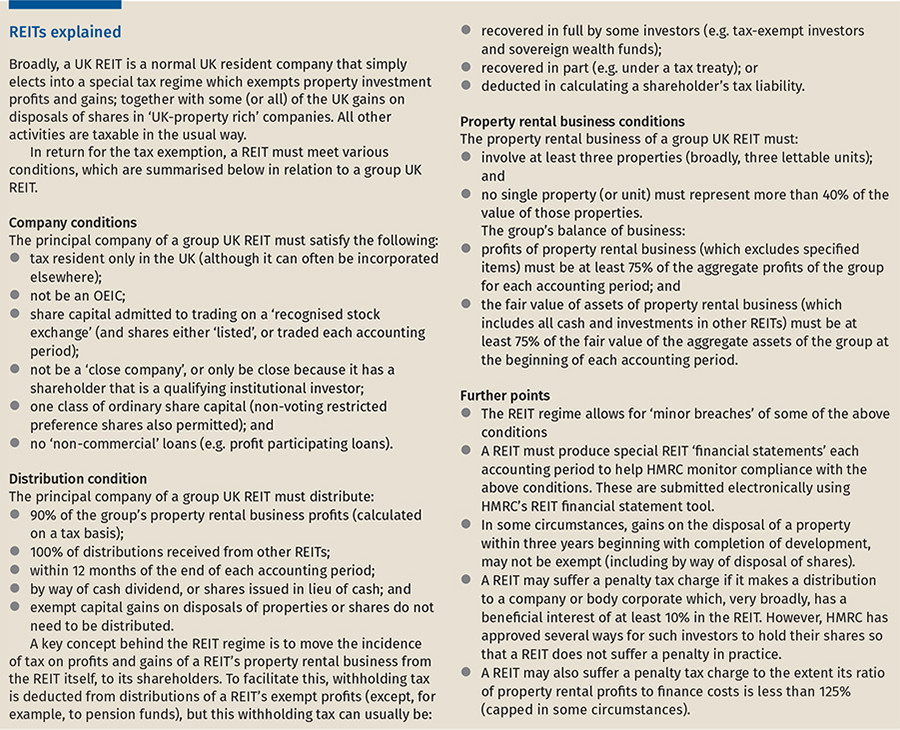

In the UK a company or group of companies can apply for UK REIT status which provides exemption from corporation tax on profits and gains from their UK-qualified property rental. REITs benefit from some pretty special tax advantages. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

As a Real Estate Investment Trust REIT British Land must follow certain rules relating to money it distributes to shareholders and how those distributions are taxed. Taxation Of Reits Ringing In The Changes A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends Tax. A separate study was conducted a decade ago projecting 66 in 2026.

Where the UK-REIT satisfies the relevant conditions its rental income is exempt from corporation tax as are capital gains on the disposal of rental properties. REIT dividends pay ordinary income at up to 37 a return to 39 under their regular income classification. The UK real estate investment trust REIT regime applies to companies and groups that meet certain conditions with the effect that the income profits and capital gains of their qualifying.

90 of the tax-exempt. The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT distributes to. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets.

Depreciation and Return of Capital. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received.

These property-owning companies receive tax benefits in return for paying out most of their income as dividends. The REIT is exempt from UK tax on the income and gains of its property rental business. Published 23 Mar 2022 1044.

Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status. REIT Tax Benefits No.

How To Invest In Reits In The Uk Raisin Uk

What Are The Best Reits To Invest In United Kingdom Investing Strategy Safe Investments Marketing Jobs

How Reit Regimes Are Doing In 2018 Ey Slovakia

Conversable Economist What Should Be Included In Income Inequality Income Inequality C Corporation

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Uk Reits A Summary Of The Regime Fund Management Reits Uk

How To Invest In Reits Does It Make A Good Long Term Investment

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reits Vs Bonds In Retirement Intelligent Income By Simply Safe Dividends

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Reits Vs Real Estate Mutual Funds What S The Difference

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

Taxation Of Reits Ringing In The Changes

What Is A Real Estate Investment Trust Reit Sharesight

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

How Reit Regimes Are Doing In 2018 Ey Slovakia

Reits Uk Explained How To Invest In Property Using Reits Real Estate Investment Trusts Youtube